A better way to measure the performance of small business

Small businesses are vital to our economy – the Fiserv Small Business Index™ is the new benchmark for their performance

When we think of economic activity, towering skyscrapers and sprawling corporate campuses come to mind. But it’s the corner store, the family-owned restaurant, the independent bookstore, your plumber or accountant, and other small businesses that are the heart of local economies.

According to the U.S. Small Business Association Office of Advocacy, small businesses make up over 99% of all businesses in the United States. They account for 44% of GDP and employ nearly half of the U.S. private sector workforce.

Small businesses fuel the economy

Unlike other areas of the economy, there hasn’t been a timely and representative benchmark of small business performance based on real point-of-sale activity.

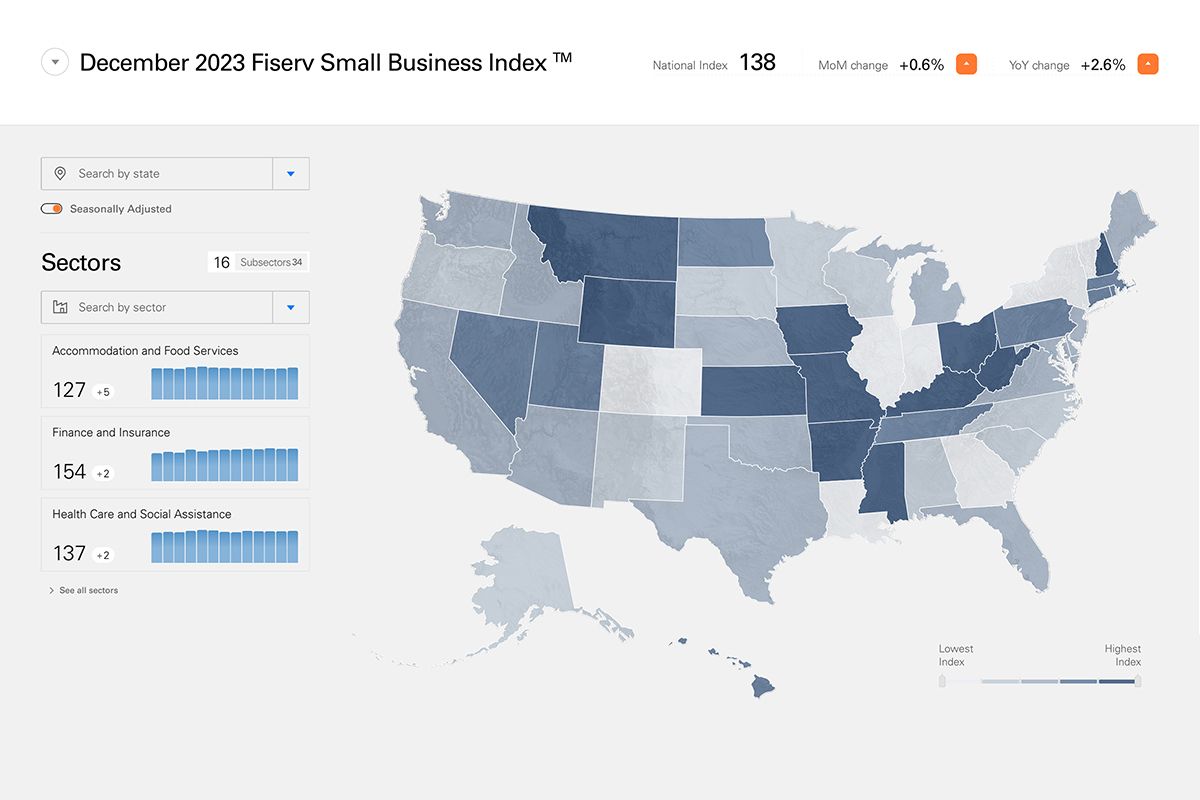

That’s why I’m delighted to unveil the Fiserv Small Business Index. Based on billions of transactions at more than 2 million businesses across the United States, the Fiserv Small Business Index provides a comprehensive, up-to-date view of the state of small business that is updated at the beginning of each month.

Providing a more comprehensive view of small business

The Fiserv Small Business Index helps the market understand the state of small business and fills a critical gap. Here’s how:

An introduction to the methodology

The Fiserv Small Business Index comprises total sales and transactions at 2 million small businesses across the U.S. The data is calibrated to the U.S. Census distribution and extrapolated to arrive at figures for all U.S. small businesses.

North American Industry Classification Systems (NAICS) codes are used to define industry sectors, with the ability to filter by NAICS code, region and state.

The Index aligns with U.S. Small Business Administration definitions and is calculated against a base period of January 2019.

1. The Fiserv Small Business Index is based on actual transactions.

Actual sales data is the highest quality measure of business performance. As the leader operating at the intersection of global commerce and financial services, we are best positioned to deliver insight into how small businesses are doing. Fiserv reaches nearly 100% of U.S. households and we have the most comprehensive view of consumer spending activity at the point of sale, along with other areas vital to understanding small businesses.

Our broad reach and access to real-time data provide a front-row seat to the economy, enabling us to measure and offer insight into small business performance based on actual point-of-sale transactions. We even include cash and check purchases to provide a full view of consumer purchases and payment behavior.

2. The Index is up to date, with the lowest latency of any available measure.

Timely access to data magnifies the power of information. The Fiserv Small Business Index relies on transactions processed by Fiserv, enabling users to understand trends more quickly. Because we can see and understand actual sales data as it happens, we can ensure that the Index we publish during the first week of each month includes data for the entire previous month. Gone are the days of having to wait for statistics to be published in the middle of the month or see data adjusted and republished over time.

Drill down into seasonally adjusted and non-seasonally adjusted values, filtered by state or NAICS sectors, and compare monthly snapshots dating back to 2019 to get a fine-grain view of what’s driving growth.

3. The Fiserv Small Business Index enables a granular view of small business performance, filling a significant information gap.

The Fiserv Small Business Index includes a wide range of small-business sectors – as defined by the North American Industry Classification System. From doctors’ offices and insurance companies to gift shops and grocers, measurements on spending at small businesses will be published at the national, state and industry levels. More granular measurements at various levels of geography and industry are coming soon.

Until now, this kind of fine-grained view of small business has been missing.

Unlocking use cases

The Fiserv Small Business Index identifies trends that impact small businesses and the economy as a whole. This has many implications, including risk mitigation, benchmarking, legislative decision-making and workforce planning.

For example, the Index can help national, state and local policymakers determine legislative priorities and quantify the impact of new regulations on small businesses across industries. Business leaders can turn to the Index to better understand regions and industries and their movement, informing strategic marketing and investments.

Up-to-date market insights can influence risk mitigation as well. Let’s say a restaurant owner wants to borrow money to expand in Sacramento. A lender can use the Fiserv Small Business Index to understand how similar businesses are performing in the same market. If the restaurant is performing markedly better or worse than peers, that could provide important information for decisioning.

Fiserv is always invested in helping small businesses do better, and small businesses can use the Index for business planning. An entrepreneur looking to open a computer repair shop in Battle Creek, Michigan, can use the Index to understand how well this services sector has performed, not only this year but over the last decade or more. Suppose the aspiring business owner finds that this type of business has underperformed in Battle Creek compared to neighboring Ann Arbor. In that case, they might reconsider their planned location or even their investment.

Other use cases are easy to imagine. Employers can get a different view of hot spots for talent. Merchants can benchmark their performance against competitors and gain a better understanding of their own progress. Companies can tailor their products and services to the needs of a particular industry and location. Industry organizations can fine-tune their areas of focus.

The market will likely determine additional use cases as they apply the data to their business needs.

Explore the Fiserv Small Business Index to get started and subscribe to monthly updates.

Learn more about the Fiserv Small Business Index